Greenwich LifeSciences Investor Presentation September 2020 Filed pursuant to Rule 433 of the Securities Act of 1933 Issuer Free Writing Prospectus dated September 22, 2020 Relating to the Preliminary Prospectus dated September 8, 2020 Registration Statement File No. 333 - 238829

Greenwich LifeSciences (“we“ or “us”) has filed a registration statement (including a preliminary prospectus) (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) on Form S - 1 /A (SEC File No . 333 - 238829 ) for the offering to which this presentation relates . Such registration statement has not yet become effective . Shares of our common stock may not be sold, nor may offers to buy be accepted, prior to the time the registration statement becomes effective . Before you invest, you should read the preliminary prospectus and other documents we file with the SEC for more complete information about our company and this offering . You should read the prospectus in the Registration Statement and other documents that we have filed with the SEC for more complete information about us . You may access these documents for free by visiting EDGAR on the SEC web site at www . sec . gov or by contacting Aegis Capital Corp, 810 7 th Avenue, 18 th Floor, New York, NY 10019 , ATTN : Syndicate Department, e - mail syndicate@aegiscap . com, ( 212 ) 813 - 1010 . This presentation contains “forward - looking statements” within the meaning of the federal securities laws that involve risks and uncertainties, many of which are beyond our control . Our actual results could differ materially and adversely from those anticipated in such forward - looking statements as a result of certain factors, including those set forth in the Registration Statement . Forward - looking statements relate to matters such as our industry, business strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, financial condition, liquidity, capital resources, cash flows, results of operations and other financial and operating information . When used in this presentation, the words “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “should,” “project,” “plan,” and similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain such identifying words . The forward - looking statements contained in this presentation are based on historical performance and management’s current plans, estimates and expectations in light of information currently available to it and are subject to uncertainty and changes in circumstances . There can be no assurance that future developments affecting us will be those that we have anticipated . Actual results may differ materially from these expectations due to the factors, risks and uncertainties described in the Registration Statement, changes in global, regional or local political, economic, business, competitive, market, regulatory and other factors described in the “Risk Factors” section of the Registration Statement, many of which are beyond our control . Should one or more of these risks or uncertainties materialize or should any of our assumptions prove to be incorrect, our actual results may vary in material respects from what we may have expressed or implied by these forward - looking statements . We caution that you should not place undue reliance on any of our forward - looking statements . Any forward - looking statement made by us in this presentation speaks only as of the date on which we make it . Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them . We undertake no obligation to publicly update any forward - looking statement, whether as a result of new information, future developments or otherwise, except as may be required by applicable securities laws . Important Notices and Disclaimers 2

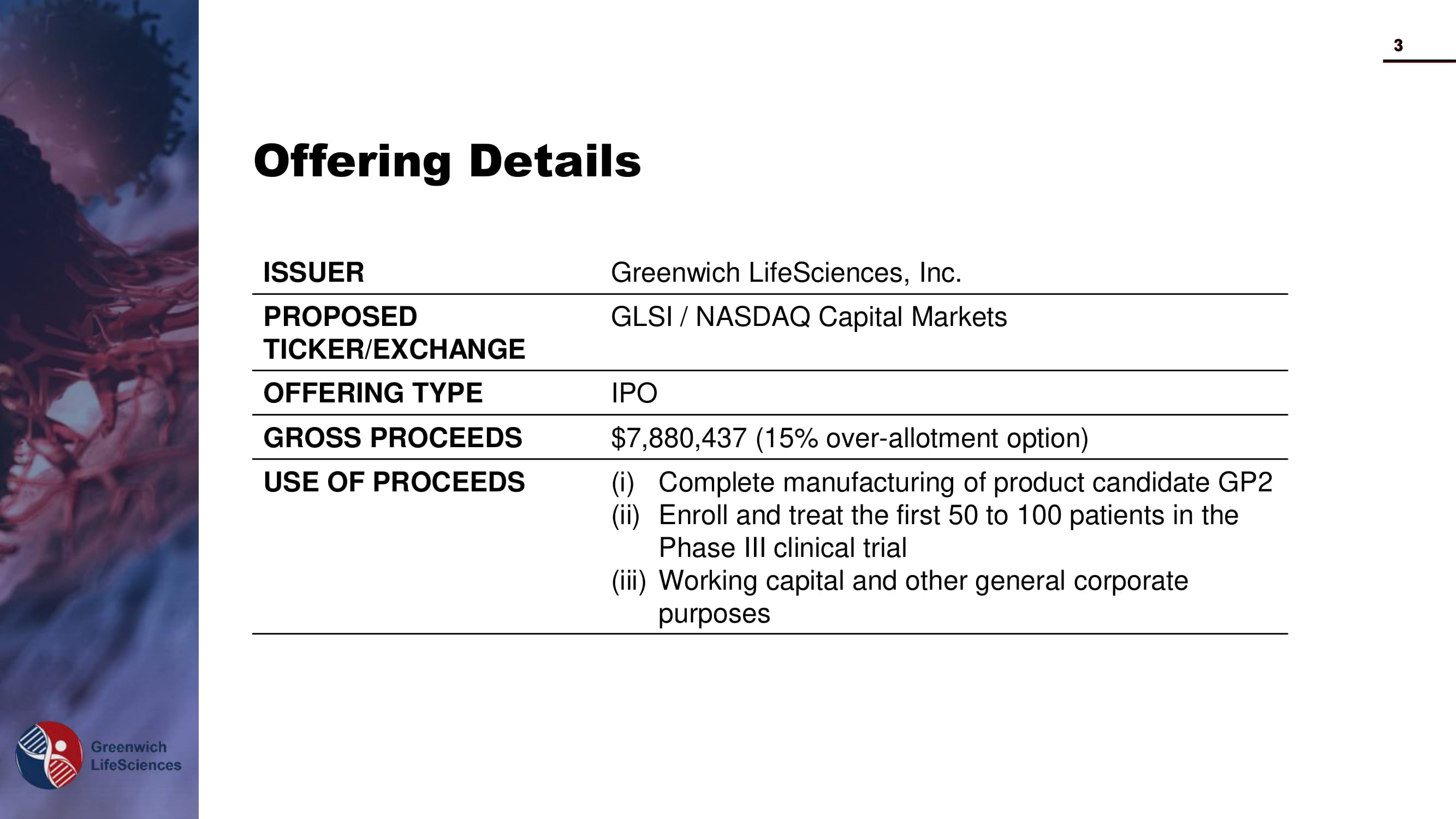

Offering Details ISSUER Greenwich LifeSciences , Inc. PROPOSED TICKER/EXCHANGE GLSI / NASDAQ Capital Markets OFFERING TYPE IPO GROSS PROCEEDS $7,880,437 (15% over - allotment option) USE OF PROCEEDS (i) Complete manufacturing of product candidate GP2 (ii) Enroll and treat the first 50 to 100 patients in the Phase III clinical trial (iii) Working capital and other general corporate purposes 3

Greenwich LifeSciences is a clinical - stage biopharmaceutical company focused on the development of GP 2 , an immunotherapy, to prevent breast cancer recurrences in patients who have previously undergone surgery • We have an exclusive worldwide license agreement with The Henry M . Jackson Foundation (HJF), the licensing arm of the U . S . military, for our lead breast cancer drug GP 2 • In a Phase IIb clinical trial of HER 2 / neu high level expressor patients completed in 2018 , no recurrences were observed after median 5 years of follow - up, if the patient received the 6 primary intradermal injections over the first 6 months (statistically significant, p= 0 . 0338 ) • Over $ 20 M in private capital and grants have been invested in our lead breast cancer drug About Us 4

Breast cancer and other solid tumors with an elevated expression of HER 2 / neu protein are highly aggressive with an increased disease recurrence and worse prognosis • HER 2 / neu is expressed in a variety of common cancers, including 75 % of breast cancers at low, intermediate, and high levels • GP 2 immunotherapy elicits a targeted immune response against HER 2 / neu expressing cancers • In the Phase IIb clinical trial, GP 2 immunotherapy produced a potent immune response and a well tolerated safety profile GP2: A Breakthrough Targeted Immunotherapy 5

Following breast cancer surgery, a HER 2 / neu high level expressor patient receives Herceptin in the first year, with the hope that their breast cancer will not recur, with the odds of recurrence slowly decreasing over the first 5 years after surgery • Herceptin has been shown to reduce recurrence rates from 25 % to 12 % in the adjuvant setting • Kadcyla has been shown to reduce recurrence rates from 22 % to 11 % in the neoadjuvant setting We believe that GP2 may be used to address the 50% of recurring patients who do not respond to either of Genentech’s FDA approved drugs Herceptin or Kadcyla Substantial Unmet Need 6

1 in 8 U . S . women ( 12 . 4 % ) will develop invasive breast cancer over her lifetime, with 266 k new breast cancer patients per year in 2018 • GP 2 ’s target market is 6 - 30 % of available breast cancer market or up to 2 . 4 x that of Herceptin in adjuvant setting ‒ Herceptin’s estimated global revenue in 2019 was $ 7 billion • GP 2 could be a long - term treatment that treats survivors ( 3 . 1 million as of 2018 ) • GP 2 potential for > $ 15 , 000 per dose pricing, with 11 doses over 3 years in initial indication 7 The Potential Market for GP2 is Large

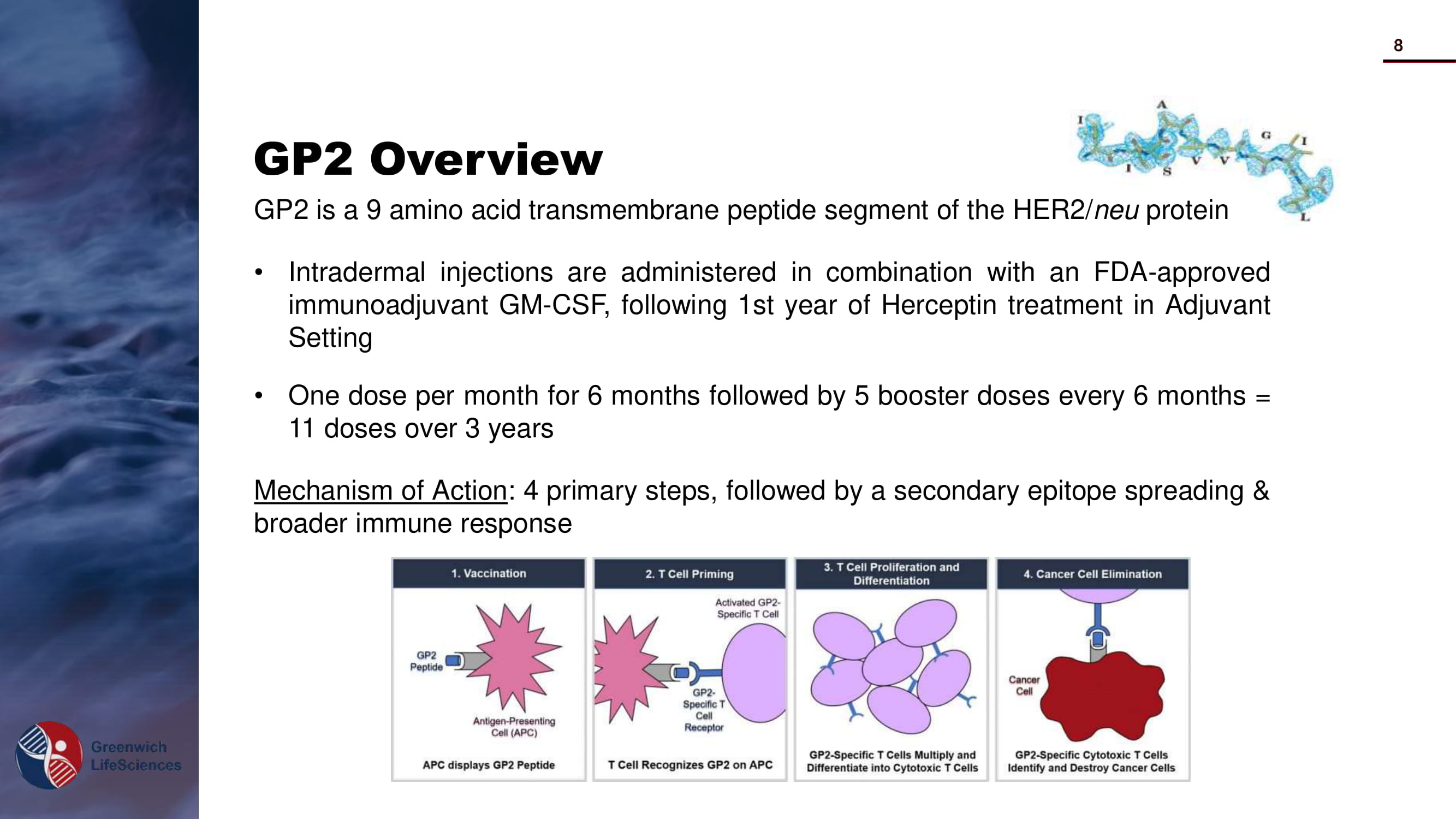

GP2 Overview GP 2 is a 9 amino acid transmembrane peptide segment of the HER 2 / neu protein • Intradermal injections are administered in combination with an FDA - approved immunoadjuvant GM - CSF, following 1 st year of Herceptin treatment in Adjuvant Setting • One dose per month for 6 months followed by 5 booster doses every 6 months = 11 doses over 3 years Mechanism of Action : 4 primary steps, followed by a secondary epitope spreading & broader immune response 8

GP 2 displayed efficacy in a Phase IIb clinical trial of 180 patients led by MD Anderson Cancer Center • After median 5 years of follow - up, there were 0 % cancer recurrences in HER 2 / neu high level expressor patients when fully vaccinated versus 11 % placebo recurrence rate ( 96 patients , p= 0 . 0338 ) • In the Phase IIb and three Phase I clinical trials there were no reported serious adverse events related to GP 2 treatment ( 138 patients) • Combining Herceptin in year 1 and GP 2 in years 2 - 4 may lower breast cancer recurrences • In the initial GP 2 indication, approximately 17 , 000 new patients could be treated per year in the US, saving up to 1 , 500 to 2 , 000 lives per year Compelling Phase IIb Clinical Data 9

We are planning to launch a Phase III clinical trial in late 2020 or early 2021 , using a similar treatment regime as the Phase IIb clinical trial • The manufacturing plan and the Phase III trial protocol have been reviewed by the FDA and final revisions to the Phase III trial protocol are underway • Manufacturing of the GP 2 active ingredient for the Phase III trial is complete and we are currently in the process of finalizing our engagement of clinical research organizations for the Phase III clinical trial • Enrollment period of up to 2 years with primary endpoint to compare recurrence rate of GP 2 - treated patients vs . placebo at median 2 , 3 , 4 & 5 - years follow - up using standard of care Upcoming Phase III Clinical Trial 10

Our corporate strategy includes advancing GP 2 into a Phase III clinical trial in the U . S . with favorable regulatory designations and pursuing a European and global clinical trial strategy to support GP 2 registration outside of the U . S . • We are considering various options to fund the Phase III clinical trial including financing and/or strategic transactions • Our strategy also includes, among other things, building a commercialization team, pursuing additional funding after this offering, and pursuing strategic collaborations to support the future global marketing and sales of GP 2 • A long term global and regional licensing process has been initiated and will continue as the Phase III trial commences • We are developing follow - on indications for GP 2 by designing and planning additional clinical trials to expand the breast cancer patient population and to pursue additional HER 2 / neu - expressing cancers Corporate Strategy and Pipeline 11

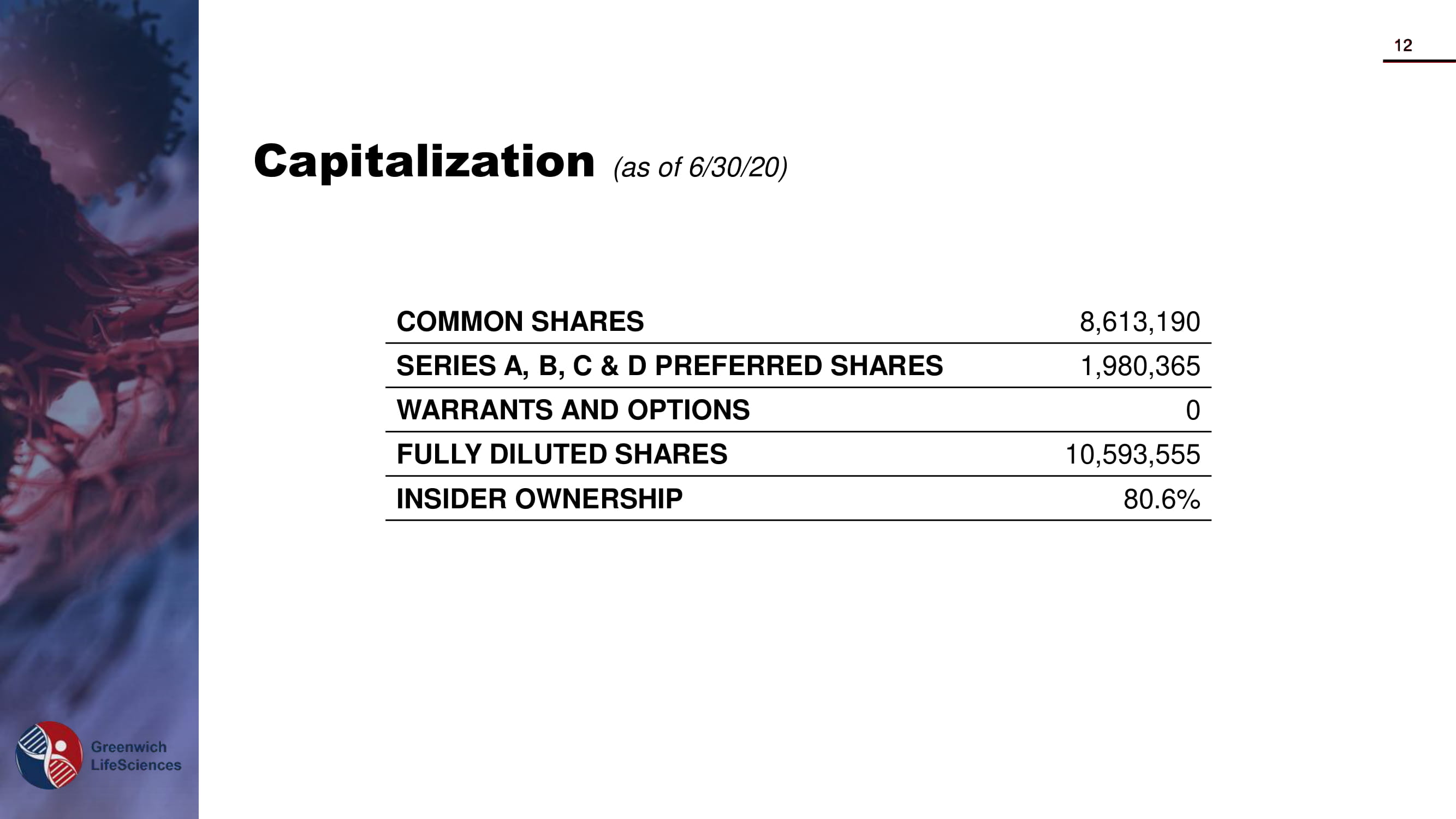

Capitalization (as of 6/30/20) COMMON SHARES 8,613,190 SERIES A, B, C & D PREFERRED SHARES 1,980,365 WARRANTS AND OPTIONS 0 FULLY DILUTED SHARES 10,593,555 INSIDER OWNERSHIP 80.6% 12

• David McWilliams, MBA – Chairman, Board ‒ 40 years of start - up / CEO experience ‒ CEO of 2 private and 3 public biotech companies • Snehal Patel, MS, MBA – CEO, Board ‒ 30 years of biopharma / Wall Street experience ‒ Large pharma operations / management experience • Joe Daugherty, M . D . – CMO, Board ‒ 35 + years of biopharma experience ‒ Assisted over 20 public and private companies • Jaye Thompson, Ph . D . – VP Clinical & Regulatory ‒ 30 years of active involvement in over 200 clinical trials for drugs, biologics and devices ‒ Founder of multiple CROs • Eric Rothe, MBA – Board ‒ Founder of GLS • Ken Hallock, MBA – Board Seasoned Management Team The management team has substantial experience in commercializing biotech products, and maintains a controlling interest in GLS, facilitating rapid and decisive decision - making 13

• Investment opportunity initially focusing on a breakthrough targeted immunotherapy for 6 % to 30 % of breast cancer market ‒ GP 2 may be used to address the 50 % of recurring patients who do not respond to existing treatments • GP 2 has demonstrated the ability to dramatically effect breast cancer recurrences ‒ GP 2 Phase IIb resulted in no breast cancer recurrences • Planning to launch a Phase III clinical trial of GP 2 in late 2020 or early 2021 • Significant private capital and grants have been invested in GP 2 • Seasoned management team with Big Pharma experience Investment Highlights 14